Welcone To PM Surya Ghar Yojana Muft Bijli Yojana

Make your Solar Stock portfolio even stronger now

Retail investors should focus on adding fundamentally strong stocks to their portfolio rather than chasing cheap stock prices. Holding these stocks for at least three to five years can provide good returns despite market volatility, elections or global challenges such as Covid-19. In this article, we will talk about some such solar stocks that will give you strong returns in the coming years and that you should definitely include in your portfolio.

1. Kotyark Industries

Kotyark Industries is a leading company in the renewable green energy and natural resources sector. This company’s manufacturing facility in Rajasthan produces biodiesel with an annual capacity of 82,500 kiloliters. Kotyark Industries is one of the top companies in the renewable energy sector delivering a 54% three-year and one-year return or 244% on its share price.

With a strong presence in green energy and strong returns, Kotyark Industries is an attractive option for investors. The production capacity for biodiesel and the growing demand in the green energy sector make it a sustainable and profitable investment.

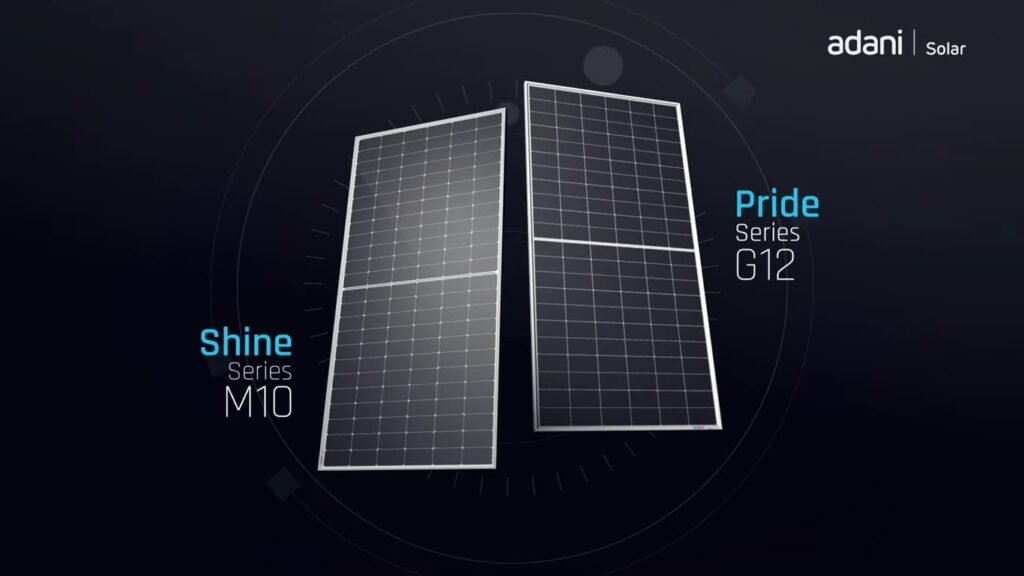

2.Adani Green Energy Limited

Adani Green Energy Limited (AGEL) is India’s largest private thermal energy producer with a thermal power plant capacity of 15,250 MW and a solar power plant capacity of 40 MW. The market capitalization of AGEL is approximately ₹2,29,834.99 crore. The 52-week high of AGEL stock was ₹46.99 and the lowest was ₹210.50. AGEL shares have delivered an impressive return of 514% in the last 3 years and 11,131% in the last 5 years. These numbers make the company an attractive option for investors.

3. INDO AMINES LTD

INDO Amines LTD consistently pays dividends and maintains profitability, offering excellent Return on Equity (ROE) and Return on Capital Employed (ROCE). The stock is currently trading at a low price and is available at a discount from its 52-week high. Today, investing in INDO Amines LTD would be a good decision considering the company’s good financial situation. Given its strong growth potential, this company emerges as a good choice for today’s investors.

Also see: Stocks of 5 solar energy companies that can make you huge profits